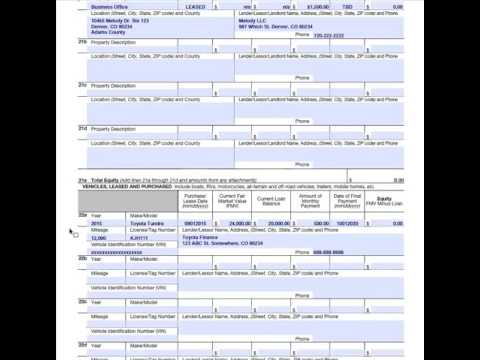

Hello my name is Amanda Kendall with true result tax professionals LLC today I'm coming to you to show you how to fill out a form for 33b which is a collection information statement for businesses. This form is going to be used for any business entity, not a sole proprietorship, that owes the IRS on back taxes, whether that is for income taxes or any type of payroll taxes. This will be used regardless of whether you are assigned to a revenue officer or if you are with the main collections department. Section one is going to be your business information. You're going to put in your business name in the address and put in your phone number of the type of business and the website over in section two you're going to put in your employer identification number and then the type of entity that you are. If you're not sure if you can look at your tax return and usually figure this out based on the type of tax return that you file, and then the date that you were incorporated or established, this can be found by going to the secretary. If you're not sure also usually found on your business tax returns section three is going to be for businesses who are also employers. So this is only if you have employees that are being paid on a w-2 that you are withholding taxes from you. You're going to put in how many employees you have how much your monthly gross payroll is not your net number this is your gross number how often you're making your tax deposits and whether you're doing that through the FTPS system online with the IRS. Question four is asking you if you engage in e-commerce or internet sales. And...

PDF editing your way

Complete or edit your irs form 433 b anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 433 b directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 433b as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your form 433b by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 433-B

About Form 433-B

Form 433-B, also known as the Collection Information Statement for Businesses, is a financial document required by the Internal Revenue Service (IRS) in the United States. This form is used to gather detailed financial information about a business that owes back taxes or is unable to pay its tax liabilities in full. Form 433-B is primarily used by businesses to provide a comprehensive overview of their financial situation, including assets, liabilities, income, expenses, and cash flow. It requires the business owner to disclose information about bank accounts, receivables, investments, vehicles, real estate, and other assets, as well as details about outstanding loans, taxes owed, and expenses. The form is typically required when a business is seeking an installment agreement or an offer in compromise from the IRS to settle their tax debts. It provides the IRS with a clear understanding of the business's financial status and helps determine the taxpayer's ability to make payments or negotiate a settlement arrangement. In summary, Form 433-B is necessary for businesses that owe taxes and are unable to pay in full. It helps the IRS evaluate the business's financial situation and determine appropriate payment options or debt settlement agreements.

What Is 433b?

Online solutions make it easier to organize your file management and raise the productivity of the workflow. Look through the short information in an effort to fill out Irs 433b?, stay away from errors and furnish it in a timely way:

How to fill out a Form 433 B?

-

On the website with the form, click on Start Now and move towards the editor.

-

Use the clues to fill out the appropriate fields.

-

Include your individual data and contact data.

-

Make certain you enter correct information and numbers in appropriate fields.

-

Carefully verify the written content of your blank so as grammar and spelling.

-

Refer to Help section if you have any concerns or contact our Support staff.

-

Put an electronic signature on your 433b? Printable while using the support of Sign Tool.

-

Once the form is finished, press Done.

-

Distribute the ready document through email or fax, print it out or save on your gadget.

PDF editor lets you to make improvements to your 433b? Fill Online from any internet connected gadget, personalize it in line with your requirements, sign it electronically and distribute in different ways.

What people say about us

How you can complete forms without mistakes

Video instructions and help with filling out and completing Form 433-B